Published by Chuck Egboka | Visit the Book Page »

Learn how to evaluate Canadian Dividend Aristocrats using time series forecasting in R. Discover the benefits, risks, and criteria of dividend investing in Canada.

📈 What Are Canadian Dividend Aristocrats?

Canadian Dividend Aristocrats are companies with a proven track record of increasing dividends over multiple years, making them a favourite among long-term investors. Unlike U.S. Aristocrats, Canadian firms must meet specific S&P/TSX criteria that highlight their financial health and consistency.

✅ Criteria for Canadian Dividend Aristocrats

To be included in the S&P/TSX Canadian Dividend Aristocrats Index, companies must:

- Be a constituent of the S&P Canada Broad Market Index

- Increase dividends for at least five consecutive years

- Have a market cap of $300 million+

- Maintain a minimum trading volume

These requirements ensure only companies with solid fundamentals make the cut.

💡 Why Invest in Dividend Aristocrats?

Dividend Aristocrats aren’t just stable—they’re strategic investments that blend income and long-term growth.

🔹 Key Benefits:

- Steady Cash Flow: Regular dividend payments, ideal for retirement income

- Financial Strength: Dividend growth indicates profitability and sound management

- Reduced Volatility: Typically less sensitive to market swings

- Dividend Reinvestment: Compound your returns over time

- Tax Efficiency: Favourable treatment in TFSA/RRSP accounts

⚠️ Risks of Dividend Aristocrat Investing

No investment is without risk. Even stable companies can face challenges that affect dividend policies or stock performance.

🚩 Potential Risks:

- Dividend Cuts during economic downturns

- Overconcentration in the financial and energy sectors

- Interest Rate Exposure that may affect the stock price

- Backward-Looking Bias: past performance ≠ future returns

🔍 Why Time Series Forecasting Is the Missing Piece

Instead of just relying on dividend history, investors can project future performance using time-tested statistical tools.

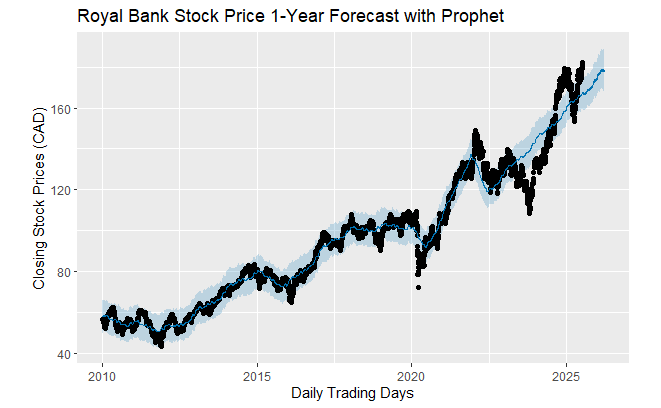

In Book 1 of my 6-book series, I show how to analyze and forecast the performance of 11 carefully selected Canadian Dividend Aristocrats using:

🔧 Forecasting Tools Covered:

- ARIMA – Ideal for short-term predictions

- SARIMA – Captures seasonality

- ETS – Great for dividend smoothing

- STLF – Seasonal Naive forecasting with short-term strength

- TSLM – Linear models with external regressors

- Prophet – Best for long-term trend forecasting

All models are implemented in R, a powerful and free open-source data science tool.

📘 Book Highlight: Foundations of Time Series Forecasting for Canadian Dividend Stocks

In this foundational guide, I introduce readers to:

✅ The fundamentals of Canadian Dividend Aristocrats

✅ How to use R to model stock price trends

✅ Forecasting dividend growth over 1, 5, 10, 15, and 20 years

Whether you’re a DIY investor, a financial analyst, or a data enthusiast, this book provides a roadmap to more informed decisions.

👉 Learn More or Buy the Book »

🔚 Final Thoughts

Dividend investing is a proven strategy, but future returns demand forward-thinking analysis. With the right models and tools, investors can move beyond “hope and hold” into a realm of data-driven dividend growth forecasting.

📊 Ready to take your investing to the next level?

📘 Start with Book 1 in the Forecasting Series »

📈 Stay Ahead with Forecast-Driven Investing

Are you interested in staying informed on the latest forecast trends and long-term projections for over 90 Canadian Dividend Aristocrat stocks, all modelled and tracked using advanced time series methods?

🔔 Subscribe to our newsletter and be the first to:

- Receive regular updates on dividend stock forecasts

- Access exclusive insights from our modelling of TSX Dividend Aristocrats

- Get early previews of our upcoming reports and analysis

- Follow the long-term growth trends of Dividend Aristocrats tracked by leading Index ETFs

Whether you’re a DIY investor, a data-driven analyst, or simply want to optimize your TFSA/retirement portfolio, this is your edge.

👉 Join our mailing list today and get the next forecast update delivered directly to your inbox.

Also, you will get the latest from the book series, in-depth insight on 11 selected dividend stocks, new blog articles and exclusive book updates.

Join our mailing list today.