Published by Chuck Egboka | Visit the Book Page »

When it comes to dividend investing, most Canadians focus on the past. They look at how consistently a company has paid dividends over the years, or how reliable its stock price has been through economic cycles. But there’s a flaw in that strategy:

Past performance isn’t always a reliable predictor of future returns.

That’s where modern, data-driven investing strategies come in—especially when dealing with the Canadian Dividend Aristocrats.

📈 What Are Canadian Dividend Aristocrats?

These are Canadian companies listed on the Toronto Stock Exchange (TSX) that have increased their dividends every year for five years or more. They’re widely seen as financially stable and investor-friendly. But even within this elite group, not all Aristocrats are created equal.

The question isn’t just “Which company has done well?”

It’s: “Which company will continue to perform over the next 5, 10, or 20 years?”

🔍 From Historical Data to Predictive Insights

This is where time series forecasting becomes a powerful tool for DIY investors.

Instead of relying on gut instinct or static valuation metrics, time series models allow you to analyze a company’s historical stock price and dividend patterns—and then forecast future trends based on that data.

These models can answer practical questions like:

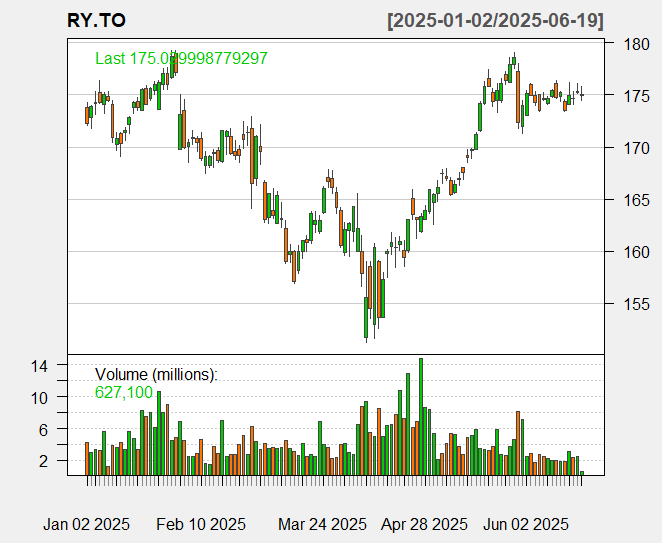

- What is the projected price of $RY.TO five years from now?

- Will $TD.TO maintain its dividend growth?

- What kind of long-term return can I expect if I buy $FTS.TO today?

🧠 Models That Make the Difference

In my new book series, I walk you through how to explore six powerful statistical forecasting models and use five of these models on 11 Canadian Dividend Aristocrats:

- ARIMA – Captures trends and seasonality in stock prices

- SARIMA – Adds seasonal components for better long-term accuracy

- ETS (Exponential Smoothing) – Great for stable dividend trends

- STLF – Seasonal Naive forecasting with short-term strength

- TSLM – A regression-based approach to forecasting

- Prophet – Facebook’s powerful model for scalable long-term prediction

Each model is implemented using R, and each chapter explores real code, plots, and forecasts over 1-year, 5-year, 10-year, 15-year, and 20-year investment horizons.

📚 Book 1: Foundations of Time Series Forecasting

Foundations of Time Series Forecasting for Canadian Dividend Stocks is the first in a six-book series that introduces investors to:

- The Canadian Dividend Aristocrats and their qualification criteria

- Why time series analysis is critical for forecasting investment performance

- How to set up your R environment and begin building your first forecast

Whether you’re a self-directed investor, data science enthusiast, or finance student, this book helps you go beyond guesswork and move into evidence-based investing.

🛠️ Who Is This Series For?

- DIY investors building a TFSA or RRSP with Canadian dividend stocks

- Analysts and data scientists interested in financial modeling

- Anyone wanting to bring machine learning and forecasting into their investment strategy

🧮 Why It Matters

In today’s volatile markets, relying on historical averages isn’t enough. Predictive models help you manage risk, identify opportunities, and project future cash flows more accurately.

And with tools like R, Prophet, and ARIMA, you don’t need to be a Wall Street quant to do it, you just need the right guide.

📘 Start Here: Book 1

🔗 Get Book 1 – Foundations of Time Series Forecasting »

📚 Or explore the full 6-book series and start forecasting your portfolio’s growth over 20 years, one dividend at a time.

Author Bio:

Chuck Egboka is a machine learning data scientist and consulting engineer with 20+ years of industry experience in the energy sector and a passion for blending AI with DIY investing. Through books, apps, and tutorials, he’s helping Canadians take control of their financial future, using the power of time series forecasting.

Published by Chuck Egboka | Visit the Book Page » When it comes to dividend investing, most Canadians focus on the past. They look at how consistently a company has paid dividends over the years, or how reliable its stock price has been through economic cycles. But there’s a flaw in that strategy: Past

📬 Stay Informed. Stay Ahead.

Subscribe to receive the latest insights on Canadian Dividend Stocks, new blog articles, exclusive book updates, and practical forecasting tips—all delivered straight to your inbox.